Graduating?

Congrats! Here are my top 4 tips

-

Do you have a Student Loan? Make sure you know what repayment looks like and set yourself up for a good credit score for years to come.

-

If you are continuing on to graduate school, check out their website for funding and connect with their financial aid & awards office. Knowledge First Financial Graduate Scholarship Awards is one you could check out.

-

Do you have a spending plan of action? You may be looking for work or already have something lined up. Be on top of your finances by setting a plan. Credit Counselling Society has a good budget calculator and I also recommend the Government of Canada budget planner.

-

Do you want Money coaching? Financial Aid & Awards Office offers that and is open during the summer too. Set an appointment.

DOING IT AGAIN! Continuing Student Scholarships

A renewed program is available to Continuing Student Scholarship recipients who are attending spring courses at Ambrose. Up to half of your award can be allocated toward spring course tuition and the other portion can be allocated toward fall tuition.

This initiative is to assist our continuing students with the cost of education. Please contact financialaid@ambrose.edu to implement.

Remember to apply for Financial Aid by June 1.

Application is available online on Financial Aid homepage.

5 Money Saving Tips & Tricks

A quality post-secondary education is a worthwhile investment into your future, yet it can also be a considerable challenge for you to finance. We want to make sure you are equipped to manage your money wisely!

1. Make a Budget and Stick to It!

Ambrose offers Budget Worksheets for students to use to plan out a year’s worth of expenses. Planning out your expenses will help you create achievable goals and plan ahead. Even just tracking your spending will help you to see trends and keep yourself accountable with your money. Generating the habit of budgeting could save you lots of money and stress!

Here are some free budget tracking tools and resources:

- Google Sheets (there are lots of free templates to help track your spending!)

- Wally

- Goodbudget

2. Keep Your Eyes Out for Scholarships

Ambrose gives out over a million dollars to students in need. Keep your eye on the Financial Aid Blog for scholarship announcements and keep an eye on your provincial financial aid pages for external scholarships!

3. Buy/Sell Used Textbooks

Did you know that the Ambrose Lion’s Store offers used textbooks for some of your class textbooks? You can buy used textbooks at a reduced price and sell them when you are done with them to help cut some costs!

The Ambrose Lion’s Store will also buy back some of your used textbooks. Make sure to keep an eye on their Buyback lists so that you can earn some extra cash!

- Fall Semester: The lists are updated at the beginning of June, and they accept books until the first day of classes.

- Winter Semester: The lists are updated at the end of November, and they accept books until the first day of classes.

4. Cook Meals at Home Instead of Eating Out

Eating out multiple times a week can add up quickly. Buying food in bulk at the beginning of the week and freezing meals can give you something quick and easy to throw in the microwave when needed!

Did you know that the average cup of coffee in Calgary costs around $4.22? If you are drinking coffee every morning, you can save money by making your own drinks!

5. Don’t be Afraid to Ask for Help!

If you are stressed about being able to afford your studies, please ask for help! You can always talk to our Student Finance Office to set up a payment plan or book an appointment with our Financial Aid & Awards Coordinator to help you search for free money. Please note that the earlier in the semester you book an appointment, the more resources are available to you!

Ambrose Awards

Continuing Student Scholarships

- $500 and up

One application form for multiple Ambrose endowed and

annual awards for students returning to study at

Ambrose in the fall. Recipients will be notified early May.

Apply online by February 28: Undergrads or Seminary

Financial Assistance - $500 and up

One application form for multiple bursaries. Students will be

matched to a bursary or financial assistance if they

demonstrate financial need.

Apply online by June 1

Questions? Contact Roxanne Poelstra

5 behaviours that can optimize your financial health

Blog Tags

By: Financial Consumer Agency of Canada

We are living through difficult economic times and unexpected situations such as a rise in interest rates and the cost of living and increasing debt levels can lead to financial difficulties. One proactive way to set yourself up for success is to optimize your financial health. You can do this by looking for and then making small improvements in how you manage your money.

Here are five behaviours that can optimize your financial health:

Behaviour #1: Learn the difference between good and bad debt

Knowing the difference between good and bad debt will help you borrow money and use credit more wisely.

Good debt is an investment in something that creates value or produces more wealth in the long run.

Bad debt is borrowing to buy something that goes down in value or that you can’t repay on time and in full, thus incurring interest charges and more debt.

Learn more about what to consider before borrowing money.

Behaviour #2: Create and review your budget to manage your money and debt

A budget is a plan that helps you manage your money. It helps you figure out how much money you get, spend and save. Making a budget can help you balance your income with your savings and expenses.

Reviewing your budget can help you repay your debt faster. When reviewing it, put needs before wants and try reducing your expenses. You’ll be able to cut some expenses that are not necessary. This way, you’ll have more money available to repay your debts.

Use the Budget Planner to manage your money and improve your finances.

Behaviour #3: Shop around and compare your options to select the financial products and services that are right for you

Financial institutions offer many types of products and services. Before you get a new product or service, make sure it meets your financial needs. Research and compare the products and services that financial institutions offer. Make sure you understand the terms and conditions.

Learn more about choosing financial products and services that are right for you.

Behaviour #4: Set up an emergency fund for unexpected expenses

An emergency fund is money you set aside to pay for unexpected expenses.

Setting up an emergency fund helps you to:

- handle an unexpected expense without getting into debt

- avoid high-cost loans (such as a payday loan or a credit card cash advance)

- have financial control

- have peace of mind

Learn how to set up and manage an emergency fund.

Behaviour #5: Learn the basics about choosing and renewing a mortgage

When you shop for a mortgage, your lender or mortgage broker provides you with options. Make sure you understand the options and features. This will help you choose a mortgage that best suits your needs.

Learn more about choosing a mortgage that is right for you.

When your mortgage term comes to an end, you have to pay off your mortgage in full or renew it. This is a good time to review your mortgage needs and make sure you have the right product.

Learn more about renewing your mortgage.

FCAC expects banks to help individuals who are identified as consumers at risk of mortgage default. These consumers may be struggling to pay their mortgages due to exceptional circumstances.

These expectations also apply to other federally regulated financial institutions offering mortgages.

Learn more about paying your mortgage when experiencing financial difficulties.

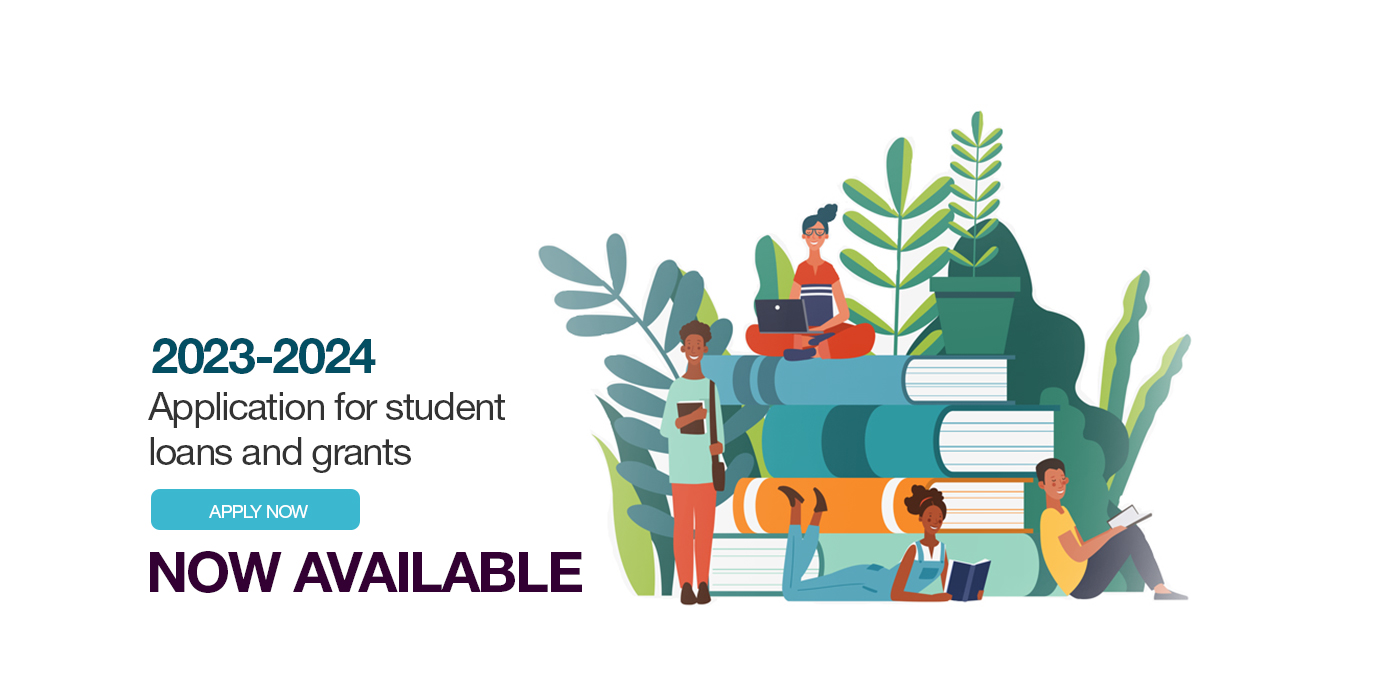

Academic New Year is Here!

Blog Tags

Apply for Loans and Grants

Students can now access the following applications:

- 2023-24 Full-time application

- 2023-24 Part-time application

Reference the following materials for help with completing the full-time post-secondary application for financial assistance:

A new resource called the Part-time Application Process helps students complete the part-time application for financial assistance. Reference the information on Section 5, which (once authorized by a school official) must be returned to the student to ensure their information is complete before they submit their application.

2023-24 Program Updates

The What's new section highlights updates to the Alberta Student Aid program, systems and policies that are effective August 1, 2023 to July 31, 2024. In addition, the Alberta Government will implement several measures to improve affordability for post-secondary students on July 1, 2023:

- Reduce interest rates on Alberta student loans to the prime rate;

- Alberta student loan interest-free grace period is extended from six months to 12 months (benefits students who completed their studies on or after Dec 1, 2022); and

- Income thresholds for the Repayment Assistance Plan increase from $25,000 to $40,000.

Please contact financialaid@ambrose.edu if you have any questions.

Summer Scholarship Special

Blog Tags

We are having a summer scholarship special offer for 2 of our programs!! This summer only, for new seats into the programs of Business or Social Sciences, we are offering an additional $1,500 while the money is still available. Don't miss out!!! Apply to either of these programs before the scholarship money runs out or if summer ends. It is that easy.

Please contact financialaid@ambrose.edu or your enrolment advisor to implement.

Spring school financing? Use Continuing Student Scholarships

Blog Tags

A renewed program is available to Continuing Student Scholarship recipients who are attending spring courses at Ambrose. Up to half of your award can be allocated toward spring course tuition and the other portion can be allocated toward fall tuition.

Please contact financialaid@ambrose.edu to implement.

Also remember to apply for Financial Aid by June 1. Application is available online on Financial Aid homepage.

Financial Literacy Newsletter - Preventing fraud in a digital world

|

|

||||||||||

|

|

|

|

||||||||||

|

|

|

|

||||||||||

|

|

|

|

||||||||||

|

|

|

|

||||||||||

|

|

|

|

||||||||||

|

|

|

|||

|

Questions? Contact Roxanne Poelstra

Leadership scholarship Re-opened until February 20

Dr. Gary McPherson Leadership Scholarship - $2,000

Have shown outstanding leadership, especially in the area of disability, and/or initiative to improve the lives of other people while attending Ambrose

.jpg)

.jpg)

.png)

.png)